Industry new

2021 for second-line power lifepo4 battery companies

Since 2016, most car companies and investors have focused on the development of second-tier power battery companies with the exception of CATL and BYD. By 2021, the overall pattern is still relatively clear.

This growth path still depends on whether there is a strategic binding of car companies. In the short term, the increase depends on domestic car companies (from the cooperation landing to the increase in 1 year), in the long term it depends on the order cultivation of global car companies. (The cycle of more than 3 years, that is, starts in 2019, and at least starts to show up in 2022).

Due to the current shifting differences in the industry, a low-cost route track for lithium iron phosphate and a high-performance ternary lifepo4 battery track have emerged.

Part One Two tracks for second-tier battery companies

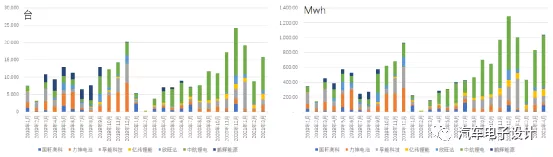

In the ternary circuit, even BYD has begun to gradually shift its strategy. In this track, the largest proportion of the second line is currently the AVIC lithium battery, which currently exceeds 10,000 units per month, and the corresponding installed capacity is 693MWh.

In the second place are Yiwei Lithium Energy and Funeng. It can be seen that these three companies can continue to go on the ternary circuit. In this regard, Lishen still has a good shipping situation in terms of ternary in 2019, and its proportion will be greatly compressed by 2020.

Figure 1 The development of Sanyuan Circuit over 2 years

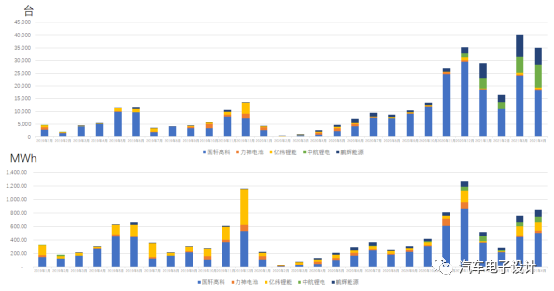

In the iron-lithium track, Guoxuan High-tech has a very high proportion of iron-lithium. In fact, Guoxuan is the first to do this in the mini-car to make a low-cost cylindrical route. Due to the continuity of iron-lithium in the bus, Yiwei has also done quite a bit before. Beginning in 2021, AVIC Lithium has also introduced iron-lithium batteries in low-speed vehicles, so the following second-line batteries have appeared in iron.

Figure 2 Two-year track changes of the second-tier battery company Fe-Li

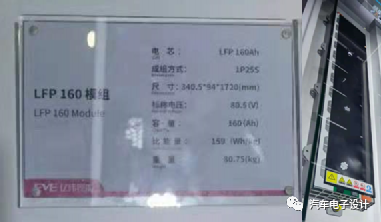

The 160Ah iron-lithium square shell and long module of Yiwei seen at the auto show, if it is really designed and developed for Tesla (currently there is no commercial confirmation in the announcement, this is a bit like a preview), then a single The amount of car companies may increase. Judging from the difficulty of the iron-lithium production line, car companies that have previously expanded their production with three yuan will also move to iron-lithium at a faster rate. Therefore, once most car companies replace low-cost batteries below 60kWh in this field, The threshold on this track is lowered.

At present, in this field, it is difficult to lock high-energy-density iron-lithium materials and battery cell design (the soft package is made of iron-lithium, except for PHEV and mini vehicles, otherwise there is no particular advantage).

Figure 3 The 160Ah module displayed by Yiwei Lithium at the Shanghai Auto Show

Part Two AVIC, Yiwei and Funeng

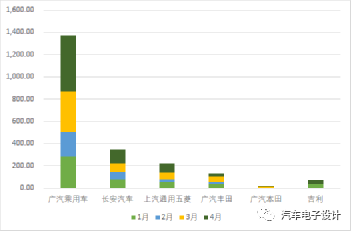

We can now take a closer look at the differences between the three companies. At present, AVIC lifepo4 battery is the fastest-growing company. At present, the main customers of AVIC are all around domestic car companies, and the strategic cooperation with GAC Passenger Cars has made it possible to ship close to 1.4GWh in 4 months (GAC Toyota and GAC Honda both follow the same path. ), the second is Changan Automobile, heading in the direction of 400MWh; the number of vehicles in SAIC-GM-Wuling has increased, but the overall volume is still around 200MWh.

From this case, we can see that a car company with about 80,000 to 100,000 units can be converted into 4.8-6GWh according to the average charge of 60kWh, which can increase the amount. Covering 2-3 domestic core customers will be able to sustainably and stably support the follow-up foreign car companies in the domestic B point.

Figure 4 Breakdown of AVIC Lithium Battery in the first four months

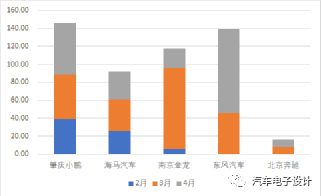

I also made a similar picture for the situation of Yiwei Lithium Energy. The main customers are Xiaopeng, Nanjing Jinlong and Dongfeng Motor. In terms of PHEV, they began to directly supply Beijing Benz. In the long run, as the demand of foreign car companies' customers goes up, shipments may be interesting from the second half of the year.

Figure 5 Yiwei's shipment trend in 2021

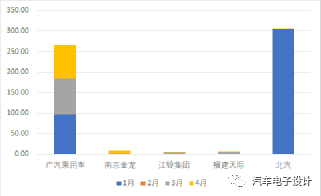

Finally, Funeng. It seems that in January, it mainly installed some for BAIC, and then GAC divided about 250MWh (there is still a big difference between it and AVIC).

Figure 6 Funeng's shipment trend in 2021

summary

At present, the estimated installed capacity can also be referenced if the insurance model * quantity * announcement data is used, but due to the difference of more than one month from the production time, the results obtained seem to be biased. The above data is for reference only and may be reflected in the insurance data 1 month later.

At present, the survival status of second-tier battery companies can better reflect the importance of car companies, and it also objectively verifies a path, that is, under the condition that the products are basically stable, if the scale of the car companies is increased, the shares and holdings of second and third-tier battery companies are both sides. The necessary and sufficient conditions for the formation of stable supply.

News

Contact Us

Companyname:Shenzhen Top New Energy Co.,Ltd.

Contact:Mr.Steven Liu

Tel:86-13602523311

E-mail:sales@topnewenergy.com

Address:Bldg 4, No. 2, Xingye Road, Songshan Lake Park, Dongguan, Guangdong.